MODULE 5 — BUSINESS MODEL DESIGN

Turning a problem into a business you can actually operate

Key Questions This Module Answers

- How do I choose the right problem to solve?

- How big does a problem need to be?

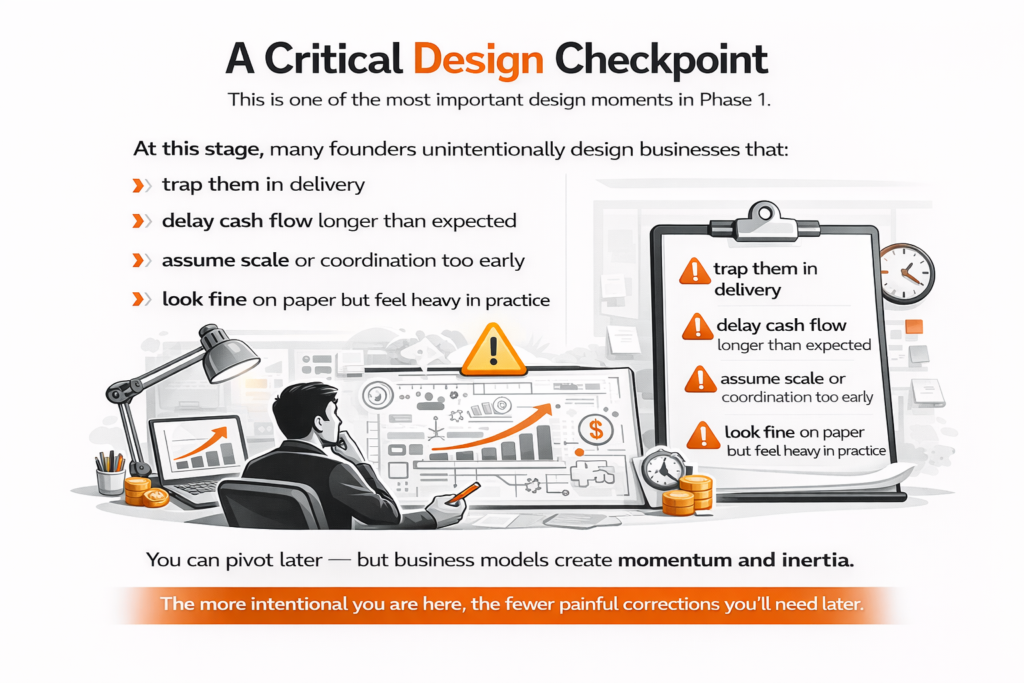

- How do I size opportunity realistically as a founder?

MODULE OVERVIEW

Up to this point, you’ve made a series of high-leverage decisions:

You’ve:

- clarified founder fit and readiness

- narrowed viable business directions

- researched markets and competitive dynamics

- selected a specific problem worth solving

- sized the opportunity realistically

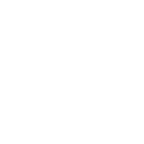

Now comes the translation step that many founders underestimate:

How does this become a real business?

This module helps you design:

- how value is created

- how it’s delivered to customers

- how money flows through the system

- where pressure shows up first

Business model design is where many founders unknowingly create businesses that are:

- harder to operate than expected

- slower to generate cash than assumed

- fragile under real-world conditions

This module exists to help you design a business that:

- works in reality, not theory

- fits your constraints

- can be operated day-to-day

- stays flexible without drifting

Why This Module Matters

Many founders believe they have a “business” when they actually have:

- a product idea

- a service they can deliver manually

- a solution without an operating structure

The business model determines:

- how effort converts into revenue

- when money comes in (and when it doesn’t)

- where stress appears first

- what assumptions must be true to survive

Business design drives outcome variance.

A weak business model doesn’t always fail fast.

Failure usually happens through sustained cash pressure and operational strain.

What a Business Model Actually Is

A business model is not:

- a pitch slide

- a pricing page

- a revenue forecast

A business model is the logic of how the business works.

Specifically:

- who you serve

- what you provide

- how it gets delivered

- how you get paid

- what activities and resources make it all possible

When these elements align, execution feels lighter.

When they don’t, friction shows up everywhere.

The 5 Canvas Blocks That Matter Most Early

All blocks matter eventually.

Early on, these five drive almost everything else.

Customer Segments

Who you are actually designing the business for.

Lack of clarity here shows up as:

- slow sales

- fuzzy messaging

- constant repositioning

Specificity creates leverage.

Value Proposition

Why a customer chooses you instead of:

- doing nothing

- using a workaround

- sticking with the status quo

This is about outcomes, not features.

Business Channels

How customers:

- discover you

- evaluate you

- decide to buy

Channels shape:

- speed to revenue

- feedback loops

- acquisition effort

Some channels reward patience.

Others punish inefficiency immediately.

Revenue Logic (Structure)

How money enters the business.

This includes:

- one-time vs recurring

- product vs service

- bundled vs unbundled

You are not setting prices yet.

You are deciding how money behaves.

Key

Activities

What must happen repeatedly for the business to function.

This is where many models quietly break:

- too much manual effort

- founder becomes the bottleneck

- complexity grows faster than revenue

If key activities don’t scale with your constraints, pressure builds fast.

If a problem is tolerated indefinitely, it’s rarely a strong foundation.

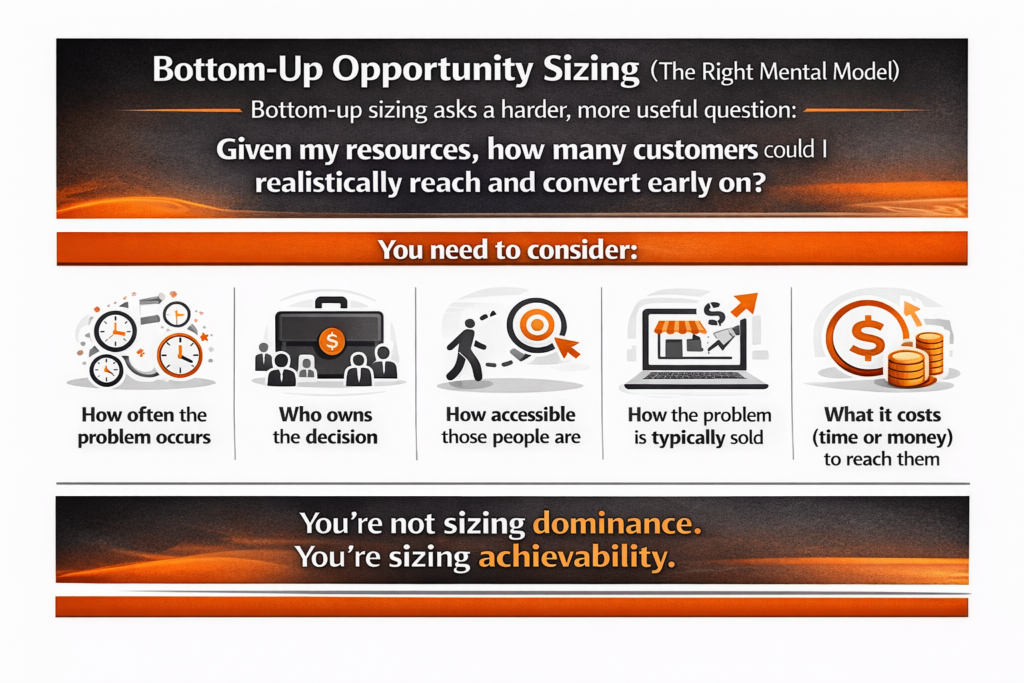

How the Business Model Controls Money Flow

This is one of the most underestimated aspects of business design.

1

Your model determines:

- when money comes in (before or after delivery)

- how predictable it is

- who floats the business (customers, you, or investors)

- where panic shows up first

2

Common founder surprises:

- delivering weeks of work before getting paid

- revenue arriving months later than expected

- inventory or onboarding tying up cash

- assuming growth fixes cash problems

3

Even if you pivot later, early money-flow decisions shape:

- stress levels

- hiring timing

survival margins

Business model design is a financial decision, not just a strategic one.

Business Model Snapshots (Intentional Contrast)

SM Services (Steven Mitts Services) — Services-Led, Cash-Flow First

- fast feedback

- early revenue

- founder time is the constraint

- model rewards clarity and focus

Full Spectrum Imaging — R&D Services & Grants

- revenue tied to credibility and outcomes

- non-linear timelines

- long gaps between progress and cash

- model rewards patience and depth

IV20 Spirits — Brand-Led, Margin-Focused CPG

- revenue driven by distribution and velocity

- capital tied up in inventory and production cycles

- regulated industry with compliance constraints

- model rewards brand equity, patience, and execution depth

Tool 1 — Business Model Canvas — Operator Version

A weighted worksheet to compare multiple problem hypotheses using:

- problem urgency

- frequency

- consequence severity

- buyer ownership

- founder obsession fit

- access to decision-makers

- early achievability

Key Takeaways

By the end of this module, you should:

- understand how business model decisions shape daily operations

- see how money flow is designed, not accidental

- recognize where pressure will show up first

- feel intentional about the tradeoffs you’re making

- maintain flexibility without drifting

Recognizing misalignment early improves long-term outcomes.

Optional Support

If this module raised questions about how your business will actually operate, you don’t have to figure it out alone.

Many founders find it helpful to review their business model with a neutral second set of eyes before moving forward.

What Comes Next

With a business model defined, the next step is deciding how you charge and how revenue scales.