MODULE 4 — PROBLEM SELECTION &

OPPORTUNITY SIZING

Choosing the right problem before you build the wrong solution

Key Questions This Module Answers

- How do I choose the right problem to solve?

- How big does a problem need to be?

- How do I size opportunity realistically as a founder?

MODULE OVERVIEW

By this point, you’ve already done what most founders skip.

You’ve:

- clarified founder fit and readiness

- narrowed business directions

- researched markets and competitive dynamics

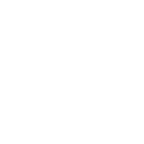

Now comes one of the most important — and most dangerous — decisions in the entire startup journey:

Which specific problem are you going to solve?

This module helps you:

- select problems that are truly worth solving

- avoid false positives that feel exciting but don’t convert

- size opportunities realistically, not optimistically

- choose problems that align with your founder fit and execution reality

Durable companies are built on well-defined problems.

This module bridges market understanding (Module 3) and business design (Module 5).

Why This Module Matters

Failure can occur even after strong early execution.

The market was real.

The timing made sense.

The founder was capable.

And the product still flopped.

Why?

Because the problem they chose was:

- too small

- too infrequent

- too indirect

- too far from a buying decision

- or misaligned with how customers actually behave

Problem selection errors are dangerous because:

- early interest looks like validation

- building feels productive

- effort increases while leverage decreases

By the time the mistake is obvious, months — sometimes years — are gone.

This module exists to help you avoid building impressive solutions to low-impact problems.

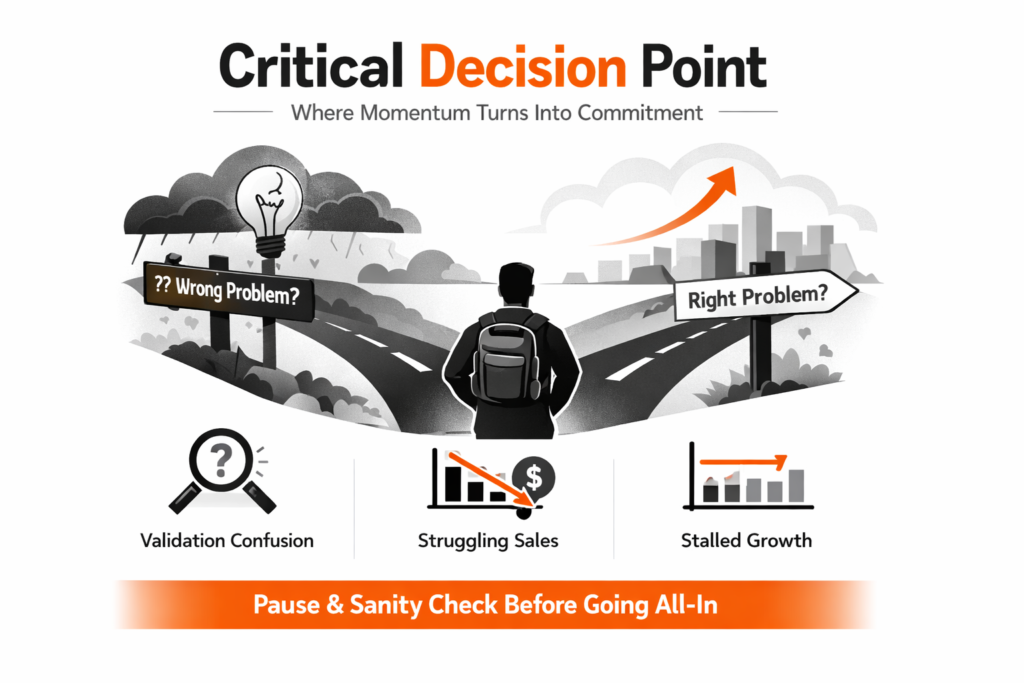

What a “Good” Startup Problem Looks Like

Strong startup problems tend to share common traits.

They are:

Frequent

not once-a-year issues

Costly

they waste time, money, or create risk

Urgent

people act on them, not just complain

Owned

someone feels personally responsible for fixing them

Unpleasant

people want them gone, not optimized

Tools, systems, AI, partners, or processes that reduce brute-force effort.

If a problem is tolerated indefinitely, it’s rarely a strong foundation.

Founder Fit Check: The Obsession Test

Before going further, ask yourself honestly:

Can I realistically obsess over this problem for the next 5–10 years?

Obsession doesn’t mean excitement every day.

It means:

- repeated exposure

- slow progress

- setbacks and ambiguity

If the answer is no, the problem may still be valid — just not valid for you.

Founder fit applies to problems, not just business models.

From Market Insight to Problem Hypotheses

At this stage, you are not committing to a single problem yet.

You are forming problem hypotheses, informed by:

- inefficiencies discovered in market research

- recurring failure modes

- customer complaints and workarounds

- gaps between how things should work and how they actually do

A strong problem hypothesis is:

- specific enough to test

- broad enough to matter

- grounded in real behavior

Example format:

“For [Specific Customer], [specific problem] occurs frequently because [underlying cause], leading to [meaningful consequence].”

Business Snapshot — FSI

Full Spectrum Imaging — Market Reality & Reachable Execution

market reports describe Total Addressable Market (TAM)

industry-level spend and macro opportunity size

global demand signals and category growth

These numbers provide context — but they do not tell you:

who you can realistically reach in the near term

who you can convince to buy based on credibility + outcomes

what’s achievable in your first 12–24 months

Founders fail when the reachable market is smaller than assumed.

Bottom-Up Opportunity Sizing (The Right Mental Model)

Bottom-up sizing asks a harder, more useful question:

Given my resources, how many customers could I realistically reach and convert early on?

This depends on:

- how often the problem occurs

- who owns the decision

- how accessible those people are

- how the problem is typically sold

- what it costs (time or money) to reach them

You are estimating attainable share.

Model what you can realistically capture.

Customer Acquisition Cost

(Introduced Lightly - more detail in future modules)

Reaching customers almost always costs something — even if it’s not ad spend.

That cost might be:

- time

- travel

- events

- memberships

- tools

- or your own effort

Understanding this cost matters because it limits:

- how many people you can reach

- how fast you can grow early

Prioritize realistic assumptions over precise numbers at this stage.

This concept will be expanded later, but it belongs here as a constraint in sizing.

Sales Motion

How a problem is sold & the speed at which it is sold matters just as much as how painful it is.

Examples:

- Some problems are solved via quick self-serve decisions

- Others require trust, relationships, or long sales cycles

- Some are pulled by urgency, others pushed by education

If your problem requires conversations, approvals, or trust — that affects how quickly opportunity can turn into revenue. This is not necessarily good or bad but it affects your market sizing.

Tool 1 — Problem Selection & Opportunity Matrix

A weighted worksheet to compare multiple problem hypotheses using:

- problem urgency

- frequency

- consequence severity

- buyer ownership

- founder obsession fit

- access to decision-makers

- early achievability

Tool 2 — Market Sizing & Achievable Opportunity Worksheet

A reality-check worksheet to estimate:

- total problem universe

- reachable buyers

- achievable customers in years 1–2

This is way more than a TAM Calculator as you customize it to your abilities

What NOT to Select as Your Core Problem

Be cautious of problems that are:

- rare or edge-case driven

- experienced by non-buyers

- easily postponed

- “nice-to-have” improvements

- dependent on major behavior change

These often generate interest — and weak businesses

Key Takeaways

By the end of this module, you should:

- distinguish meaningful problems from distractions

- understand why bottom-up sizing matters

- account for access and execution constraints

- avoid over-committing to low-impact opportunities

- feel confident about what to validate next

You should feel focused, not overwhelmed.

What Comes Next

Once you’ve selected the right problem, the next step is validating it directly with customers.

The next module will focus on:

- Voice of Customer (VOC)

- customer discovery

- validation loops that prevent overbuilding