MODULE 3 — MARKET RESEARCH &

COMPETITIVE LANDSCAPE

Finding leverage, gaps, and opportunity inside real markets

Key Questions This Module Answers

- How do I choose the right business direction?

- What business models fit my constraints?

- Do I need to raise money for this business?

MODULE OVERVIEW

After narrowing your business directions the next step is gaining a deeper understanding.

This module helps you research markets in a way that reveals:

- where opportunity actually exists

- why some companies succeed and others fail

- what’s inefficient, outdated, or changing

- how your specific founder strengths intersect with market reality

Good market research doesn’t just answer “Is this market real?”

It answers “Where could I realistically win?”

This module builds directly on Module 2 (Finding the Right Business to Build) and sets up Module 4 (Problem Selection & Opportunity Sizing).

Why This Module Matters

Founder failure often results from entering markets without sufficient understanding.

When market judgment is wrong, the cost is rarely immediate. It shows up downstream as:

- stalled validation

- weak conversion despite interest

- long or unpredictable sales cycles

- constant repositioning and rework

- months or years of effort that don’t compound

This is dangerous because it often feels like progress — building, testing, iterating — while the underlying market assumptions are flawed.

There’s another common failure mode worth calling out explicitly:

Domain expertise can become a liability.

Founders who know an industry deeply often zoom in too far — obsessing over narrow workflows, edge cases, or technical purity — and miss the broader market problem that actually drives adoption and growth.

When this happens, products feel correct but don’t spread.

This module exists to help you avoid slow, expensive failure by developing real market judgment before you commit deeply to a specific problem or solution.

Business Snapshot — IV20 Spirits

Industry: Consumer packaged goods / regulated market

IV20 Spirits is a useful example of how domain expertise can both help and hinder growth.

The original product concept was highly differentiated — terpene-infused vodka at the intersection of cannabis culture, premium spirits, and lifestyle branding. That insight created early momentum and clear positioning.

But in a highly saturated and regulated market, differentiation alone wasn’t enough.

The early risk wasn’t product quality — it was over-narrow framing:

- too niche to scale quickly

- limited distributor and retail flexibility

constrained expansion paths

Progress required zooming out — reframing the opportunity around a broader consumer and retail problem, while still preserving what made the product distinctive.

The lesson isn’t “don’t be niche.”

It’s this:

Domain insight creates advantage — until it narrows the market too far to grow.

Market research isn’t about abandoning expertise.

It’s about ensuring that expertise maps to a market large enough and dynamic enough to support the business you want to build.

What Market Research Actually Means (At This Stage)

What to Focus On When Researching a Market

Focus on leverage discovery.

Collect only the information that reveals advantage.

What Works in

This Market

Study companies that are:

- growing

- durable

- repeatedly successful

Ask:

- Where do winners focus their effort?

- What do they not do?

- How do they acquire customers?

What tradeoffs are they making?

Markets reward specific behaviors, not generic best practices.

Failure Modes & Structural Friction

Study what doesn’t work just as closely.

Look for:

- failed startups

- stalled products

- repeating customer complaints

Ask:

- Why do most companies struggle here?

- Where does complexity or cost explode?

- What consistently slows adoption?

Failure patterns often reveal opportunity surfaces.

Market

Inefficiencies

Real opportunity usually lives in inefficiency.

Look for:

- fragmented vendors with no clear leader

- manual processes people tolerate

- tools that don’t integrate

- customers stitching together hacks

- services that should be productized

If people complain but keep paying, something is broken — and valuable.

Change Forces &

“Why Now?”

Many opportunities exist because something recently changed.

Research:

- new technologies or cost curves

- regulatory or legal shifts

- platform or distribution changes

- workforce or demographic trends

Ask:

- What is now possible that wasn’t before?

- What just became cheaper, faster, or easier?

- What assumptions no longer hold?

Timing creates opportunity more often than novelty.

Founder-Specific Advantage

You are not trying to find the best market in the abstract.

You are trying to find the best market for you.

Filter everything through:

- your domain knowledge

- your access and relationships

- your founder type

- your tolerance for complexity and risk

A market that’s mediocre for others can be exceptional for you.

Pro Tip — Check Your Zoom Level

If you feel stuck, check your zoom level.

- Too zoomed in: feature-level obsession, edge cases, internal logic

- Too zoomed out: TAM, trends, and generic narratives

Strong founders move intentionally between:

- market structure

- Buyer Behavior

- Problem-Level Pain

Stalled research usually reflects the wrong level of analysis.

The issue is perspective rather than missing data.

Capital Requirements & Funding Reality

Demand still matters — but it must be interpreted correctly.

Strong signals:

- people paying for imperfect solutions

- repeated attempts to fix the same problem

- emotional language around pain

- visible workarounds

Weak signals:

- polite interest

- vanity engagement

- hypothetical surveys

- abstract enthusiasm

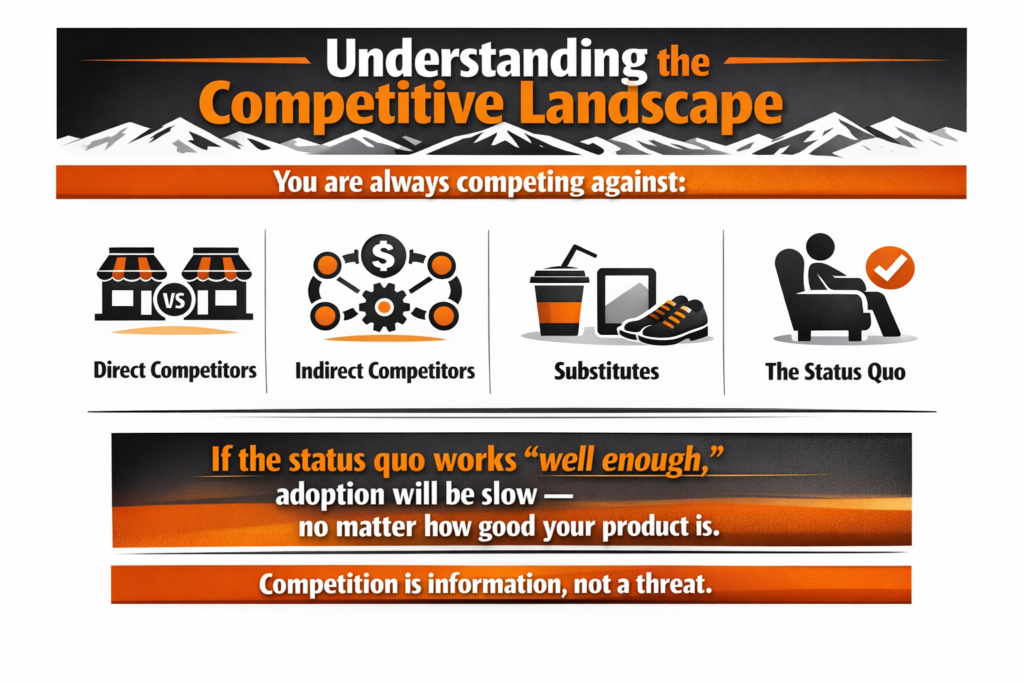

Understanding the Competitive Landscape

You are always competing against:

Market Structure & Dynamics

Some markets punish new entrants regardless of effort.

Pay attention to:

- fragmentation vs concentration

- buyer power and price sensitivity

- switching costs

- sales motion (self-serve vs relationship-driven)

A large market can still be a bad market.

What NOT to Research (Common Traps)

Be deliberate about what you ignore.

1

TAM / SAM / SOM exercises without behavioral grounding

2

vanity metrics (search volume, social engagement, press)

3

hypothetical surveys with no consequence

4

feature-by-feature competitor comparisons

5

investor narratives disconnected from buyer reality

6

edge-case users mistaken for the core market

Applying the Research:

Tool 1 — Market Attractiveness Scorecard

A weighted framework to evaluate whether a market is attractive for you, right now.

Suggested dimensions:

- problem urgency

- willingness to pay

- frequency of the problem

- customer accessibility

- speed to first customer

- clarity of success patterns

- visible failure modes

- market fragmentation

- recent structural or technological change

- founder-specific advantage

- regulatory or structural friction

Tool 2 — Competitive Landscape Map

A structured way to map:

- direct competitors

- indirect competitors

- substitutes

- status-quo solutions

Tool 3 — Market Insight Notes Worksheet

A qualitative companion to capture judgment, not just scores.

Prompts include:

- What patterns keep repeating?

- Where do customers seem most frustrated?

- What feels inefficient or outdated?

- Why do current solutions exist the way they do?

- Where might I be over-indexing on my own experience?

- Where does my founder fit create an edge?

Need a Second Set of Eyes?

This module represents a critical inflection point.

If you want help:

- pressure-testing your conclusions

- sanity-checking your market logic

- avoiding expensive downstream mistakes

Looking for Deeper Dives or Execution Support?

Related Guides & Blog Content — deeper breakdowns of market analysis and positioning

Robot Marketplace — tools to automate research, synthesis, and follow-up

Key Takeaways

By the end of this module, you should:

- understand why outcomes look the way they do in a market

- recognize success and failure patterns

- identify inefficiencies and timing-based opportunities

- avoid domain-expert tunnel vision

- see how your founder fit intersects with market dynamics

You should feel clearer, not busier.

What Comes Next

With market understanding in place, the next step is choosing the right problem to solve within that market.