MODULE 2 — FINDING THE RIGHT

BUSINESS TO BUILD

Narrowing from infinite ideas to viable directions

Key Questions This Module Answers

- How do I choose the right business direction?

- What business models fit my constraints?

- Do I need to raise money for this business?

MODULE OVERVIEW

After defining founder fit the constraint shifts to decision-making.

Today, the barrier to starting a business is lower than ever. Tools, platforms, and AI have made it possible to build almost anything with minimal upfront cost. That abundance is powerful — and dangerous.

Founder failure often results from poor decisions rather than lack of ideas.

This module helps you narrow from everything you could build to a small set of business directions that actually make sense for you — given your constraints, strengths, goals, and appetite for risk.

Not final ideas.

Not validation.

Just clarity on where to focus next.

This module builds directly on the outputs of Module 1 (Founder Fit & Readiness) and sets up every downstream decision that follows.

Why This Module Matters

Startup collapse usually traces back to backing the wrong concept for too long.

They fail because they picked:

- a direction that required scale before learning

- a business that demanded capital they didn’t have

- a model misaligned with their time, energy, or risk tolerance

- a path that forced them to spend years doing the wrong work

Early business choices create path dependency.

Once you commit to a direction, everything downstream — research, validation, hiring, funding, tooling — is shaped by that decision.

If everything sounds like a good idea right now, that’s not a strength.

It’s a signal that you haven’t filtered yet.

This module exists to help you filter before effort, attachment, or sunk cost lock you in.

Business Idea vs. Business Direction

The Goal at This Stage (Be Explicit)

You are not committing to a final idea yet.

You are:

- eliminating misaligned paths

- narrowing optionality

- identifying 2–3 directions worth deeper investigation

This keeps learning fast and regret low.

Core Filters for Choosing the Right Business Direction

Founder Leverage

Where do you naturally create advantage?

This might come from:

- domain knowledge (time spent inside an industry or role)

- technical ability (building, automating, or shipping yourself)

- relationships (direct access to buyers, partners, or distribution)

- pattern recognition (seeing the same problems across contexts)

If you have no leverage, the business relies on brute force.

Constraint Compatibility

Does this direction work inside your real constraints?

Constraints include:

- available time (10 hours/week vs full-time)

- financial runway (3 months vs 18 months)

- energy and attention (side project vs focused execution)

A direction that ignores constraints will break — sometimes early, sometimes later — but always eventually.

Speed to First Signal

How quickly can you get meaningful feedback?

Signals include:

- real customer conversations

- early revenue

- usage behavior

- strong rejection

Fast feedback reduces fantasy and wasted time.

Operational Complexity

How many moving parts are required before value is created?

More complexity means:

- slower learning

- higher coordination cost

- greater capital and execution risk

Complexity isn’t bad — but it must be intentional.

Risk

Profile

What kind of risk are you actually taking on?

Examples:

- financial risk

- reputational risk

- regulatory risk

- opportunity cost

Different founders tolerate different risks.

Misalignment here creates stress and poor decisions.

The framework favors clarity over theory.

Honest assessment drives better decisions.

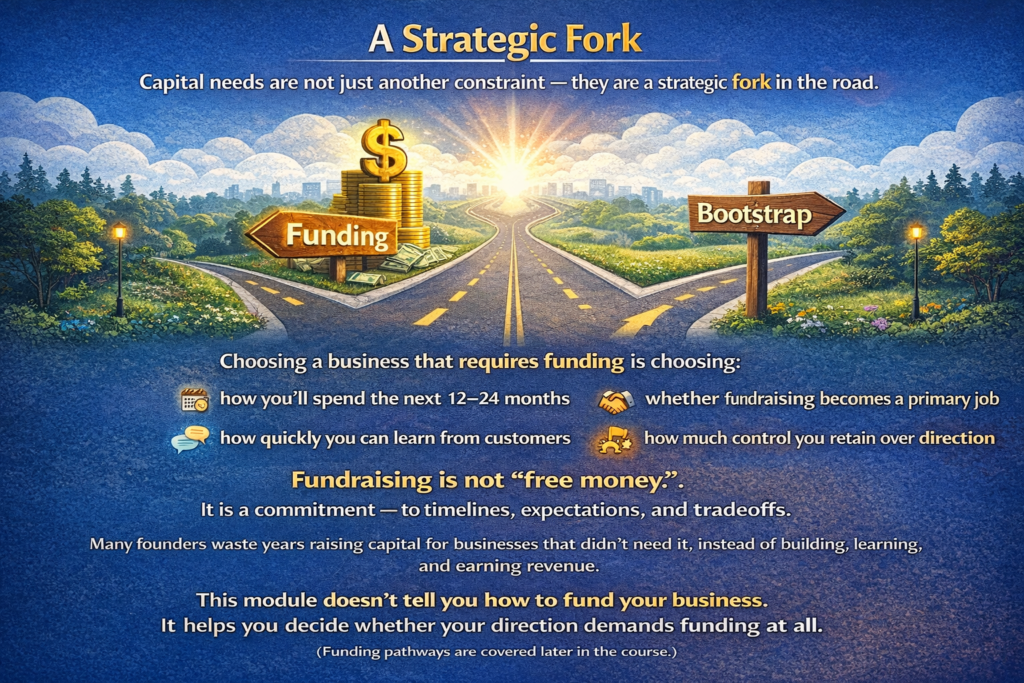

Capital Requirements & Funding Reality

Common Business Archetypes (Inclusive & Practical)

These archetypes are intentionally broad.

Most real businesses are hybrids — but nearly all start in one bucket.

Productized Services

Standardized services with defined scope and repeatability.

Examples:

- audits

- implementations

- managed services

Strengths:

- fast revenue

- fast learning

AI-Native Businesses

Businesses where AI fundamentally

Examples:

- pay-per-action tools

- performance-based subscriptions

- agent-driven workflows

Common risks:

- underestimating build-out costs

- weak defensibility without distribution or data

AI enables new business models — but it doesn’t remove fundamentals.

SaaS & Software Products

Products that scale through usage rather than hours.

Examples:

- SaaS platforms

- workflow tools

- internal tools turned products

Strengths:

- scalability

- defensibility

Agencies & Consulting

Custom solutions delivered through expertise.

Examples:

- marketing agencies

- technical consulting

- advisory services

Strengths:

- low upfront cost

- high leverage on experience

Physical Products & Retail

Businesses built around tangible goods.

Examples:

- consumer packaged goods

- DTC Brands

- wholesale or retail products

- hardware

Common characteristics:

- inventory and supply chain complexity

- capital tied up before learning

- slower iteration cycles

Excellent businesses — when planned clearly.

Content & Audience Businesses

Trust first, monetization second.

Examples:

- newsletters

- communities

- education platforms

Distribution becomes the asset.

Marketplaces

Connecting supply and demand.

Examples:

- talent platforms

- niche exchangePowerful when they work.

Difficult early.

Asset-Light Commerce

Selling without heavy inventory.

Examples:

- digital products

- licensing

- drop-ship models

Execution and differentiation matter more than novelty.

Platforms & Ecosystems

Multi-sided systems with network effects.

Rarely ideal early unless strong leverage already exists.

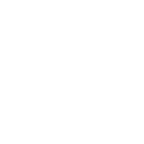

Business Direction Matrix

The Business Direction Matrix (internally known as the Idea Elimination Matrix) is a simple decision tool designed to help you compare multiple business directions using the same criteria, so you can think clearly instead of reacting instinctively.

Use the matrix to:

- Remove emotional bias from big strategic decisions

- Compare fundamentally different ideas on equal footing

- Eliminate weak directions early

- Narrow your focus to 2–3 options worth deeper investigation

This is not a tool for picking a “winner.”

It’s a tool for deciding what deserves your time next.

What to Ignore at This Stage

To maintain momentum, deliberately ignore:

- trends without distribution

- ideas that require scale before learning

- businesses that only work in perfect conditions

- “someone else did it, so I can too” logic

- pressure to pick a final idea too early

Clarity now saves months later.

Key Takeaways

By the end of this module, you should:

- understand the difference between ideas and directions

- have clear filters for evaluating opportunities

- recognize major business archetypes and tradeoffs

- know whether your direction is bootstrapped or capital-dependent

- narrow your focus to 2–3 viable business directions

No commitment is being made. You are narrowing focus.

With business directions narrowed, the next step is understanding which markets are actually worth entering.

The next module will help you:

- analyze demand

- understand competition

- spot leverage and inefficiency